Taxomate Integration Service by eSeller Accountant: Automate Your eCommerce Accounting

Managing eCommerce sales across platforms like Amazon, Shopify, and eBay can be a real challenge—especially when you’re stuck reconciling every transaction, fee, and refund by hand. At eSeller Accountant, our Taxomate Integration Service takes the stress out of bookkeeping by automatically transferring your sales data into your accounting system—whether you use Xero, QuickBooks Online, or NetSuite ERP. With accurate, up-to-date financial records at your fingertips, you can spend less time on admin and more time growing your business.

Taxomate to Xero Integration: Automate Your Amazon, Shopify, and eBay Sales Data with Xero

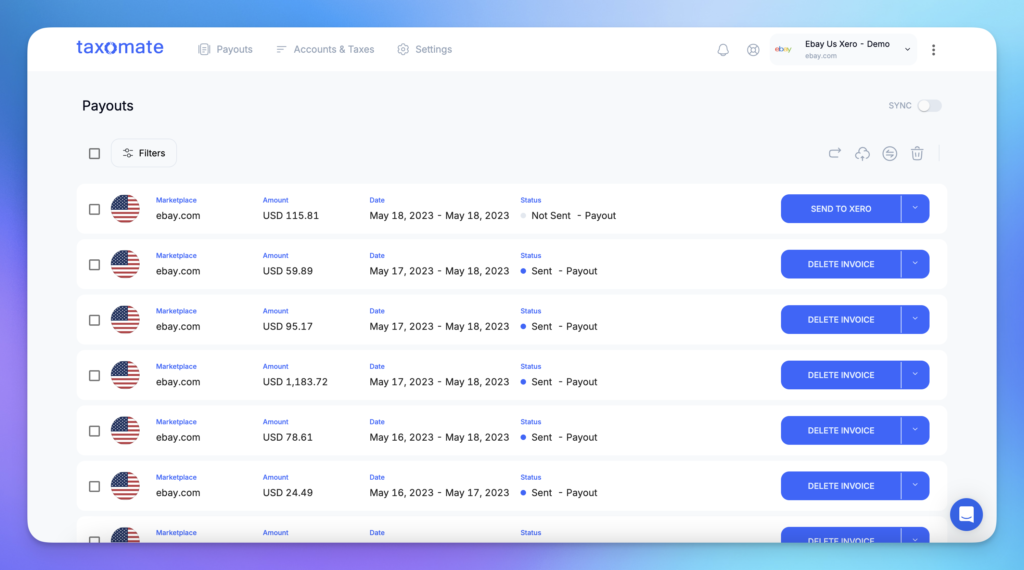

Taxomate seamlessly integrates with Xero, automating the transfer of your Amazon, Shopify, and eBay sales data directly into Xero’s accounting software. Every sale, fee, and refund is accurately recorded, making reconciliation effortless and ensuring that your financial records are reliable. With Taxomate to Xero, you can maintain clean, organized books without manual data entry, saving you time and reducing the risk of errors.

Our Xero integration leverages advanced API-based connectivity, supporting both Xero Standard and Premium plans for comprehensive functionality. The system processes up to 10,000 transactions daily through automated summary entries, with custom chart of accounts mapping to match your business structure. Multi-currency support is built-in, featuring automated exchange rate updates to ensure accurate international transaction recording.

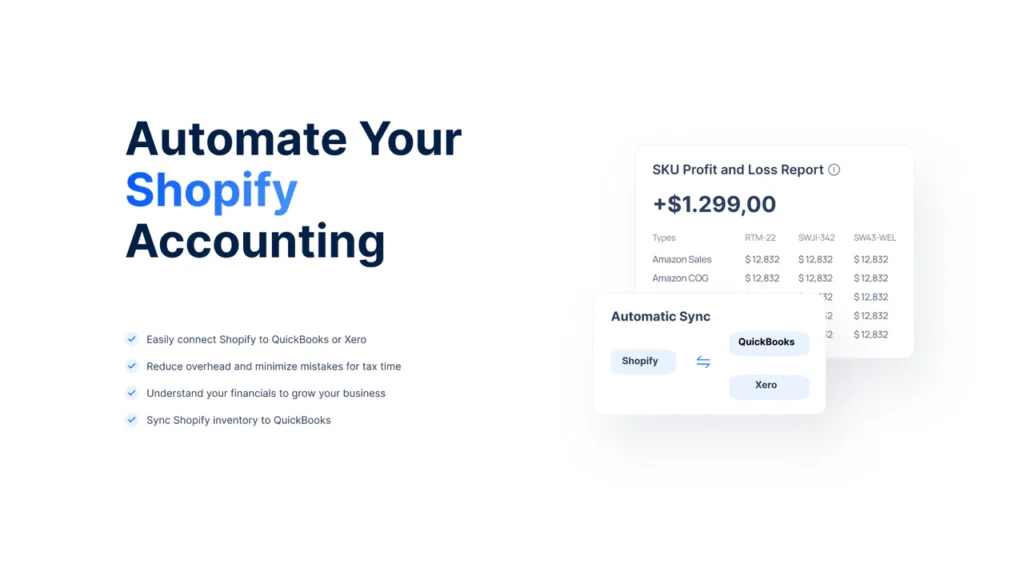

Taxomate to QuickBooks Online Integration: Streamline Your eCommerce Accounting with QuickBooks

Simplify your eCommerce accounting by integrating Taxomate with QuickBooks Online. Taxomate automates the import of your Amazon, Shopify, and eBay sales transactions into QuickBooks, ensuring accurate financial records and easy reconciliation. Whether you’re dealing with large volumes of transactions or running multiple sales channels, Taxomate to QuickBooks Online makes your bookkeeping fast, reliable, and scalable.

Our QuickBooks Online integration provides real-time synchronization through dedicated API connections, compatible with all QuickBooks Online plans from Simple Start to Advanced. The system supports advanced features including class and location tracking, alongside custom field mapping for detailed transaction management. Our solution handles up to 50,000 daily transactions, automatically managing inventory value adjustments and marketplace fee splits for comprehensive financial tracking.

Why Taxomate Integration is Critical for Your eCommerce Accounting

Taxomate automates the import and categorization of your sales transactions, giving you an organized, real-time view of your finances. Here’s why Taxomate is the preferred solution for thousands of online sellers:

Accurate Financial Data

Our system delivers real-time transaction verification with 99.9% accuracy in bank reconciliation. Automated monitoring handles fees, currency conversions, and error detection for precise financial records

Automatic Data Syncing

Taxomate performs automatic imports every 30 minutes with smart matching algorithms. Our system ensures accurate data syncing while learning from transaction patterns for improved performance.

Tax Automation by Region

Taxomate automatically handles VAT, sales tax, and local taxes across global regions. Our system calculates rates in real-time and generates compliance reports for all jurisdictions.

Multi-Platform Support

Taxomate integrates with major platforms including Amazon, Shopify, eBay, and more. Your financial data flows seamlessly into your accounting system from any marketplace.

Efficient Reconciliation

Our smart reconciliation system automatically matches bank deposits with marketplace sales. Real-time verification catches discrepancies instantly, eliminating hours of manual reconciliation work.

Advanced Analytics and Reporting

Our analytics suite provides real-time dashboards of performance metrics, profit margins, and sales trends. Custom reports help optimize business decisions across all marketplaces.

How Our Taxomate Integration Service Works

1

Initial

Consultation

We begin by assessing your system compatibility and analyzing your accounting workflow. Through detailed discussions, we design a custom solution that addresses your unique business requirements.

2

Tailored Taxomate

Configuration

Our team establishes platform-specific API connections and implements custom field mapping. We configure tax codes, sync schedules, and test environments to ensure proper system functionality.

3

Automated Data

Syncing

We carefully import historical data and implement real-time sync verification. Our team configures performance monitoring systems and automated alerts to maintain smooth data flow.

4

Ongoing

Support

We provide dedicated technical support during business hours and regular system optimization. Our team conducts periodic maintenance checks and updates to ensure consistent performance and reliability.

Simplified Sales Tax & VAT Compliance

Managing sales tax and VAT across different regions can be challenging, but Taxomate automates this process for you:

UK and EU VAT

Taxomate automatically breaks down VAT for each transaction, ensuring compliance with local tax regulations and simplifying VAT return filings.

US Sales Tax

Taxomate handles the complexities of state-by-state sales tax in the US, calculating and reporting accurate sales tax based on your transactions.

Global Tax Compliance

Taxomate supports multi-region tax reporting, ensuring compliance with VAT, GST, and other local tax regulations for international sellers.

Why Choose eSeller Accountant for Taxomate Integration?

At eSeller Accountant, we are experts in eCommerce accounting with a deep understanding of Taxomate integration with platforms like Xero, QuickBooks Online, and NetSuite ERP. By partnering with us, you can streamline your accounting processes, ensure compliance with local tax regulations, and reduce the manual workload involved in managing large volumes of transactions. Whether you’re a small eCommerce seller or a large enterprise, our Taxomate Setup and Integration service ensures accuracy and efficiency across your accounting operations.

Frequently Asked

Taxomate is an advanced eCommerce accounting automation tool that integrates seamlessly with platforms like Amazon, Shopify, and eBay to sync sales data into accounting software like Xero, QuickBooks Online, and NetSuite ERP. It automates transaction reconciliation, fee tracking, VAT compliance, and multi-currency conversions, eliminating manual bookkeeping and saving hours of accounting work.

Taxomate connects directly with Xero via API, automating the import of sales, fees, and refunds from Amazon, Shopify, and eBay. This integration ensures accurate financial records, real-time reconciliation, and tax compliance. With support for up to 10,000 transactions daily, multi-currency conversions, and custom chart of accounts mapping, Taxomate ensures that your books stay accurate and up to date without manual data entry.

Taxomate’s integration with QuickBooks Online streamlines eCommerce accounting by automatically importing and categorizing transactions from Amazon, Shopify, and eBay. With features like real-time synchronization, advanced reporting, and support for up to 50,000 transactions per day, Taxomate eliminates manual data entry and ensures seamless reconciliation. It also supports inventory tracking, fee categorization, and multi-location accounting, making it an ideal solution for high-volume eCommerce sellers.

Yes, Taxomate automates VAT and sales tax calculations for eCommerce businesses operating in multiple regions, including the UK, EU, and the US. The system automatically applies the correct tax rates, generates compliance reports, and integrates with HMRC’s Making Tax Digital (MTD) framework. For US sellers, Taxomate manages state-by-state sales tax calculations and filings, ensuring full compliance with tax authorities.

Taxomate’s smart reconciliation engine matches bank deposits with marketplace sales in real time, reducing accounting errors and saving hours of manual work. Its automatic transaction verification system identifies discrepancies instantly, ensuring that sales, refunds, and fees are accurately recorded. With a 99.9% accuracy rate in bank reconciliation, Taxomate helps businesses maintain error-free financial records and close their books faster.

At eSeller Accountant, we specialize in eCommerce accounting automation, helping businesses seamlessly integrate Taxomate with Xero, QuickBooks Online, and NetSuite ERP. Our expert team provides customized setup, real-time monitoring, and ongoing support, ensuring a smooth, error-free integration tailored to your business needs. Whether you’re a small online seller or a high-volume enterprise, our Taxomate Setup and Integration Service enhances accuracy, efficiency, and compliance in your financial management.

No, we don’t provide tax submission services. However, we can introduce you to our local partners for tax return submissions, including Annual Financial Statements (USA, Canada), Annual Financial Reports (Australia), or Financial Statements (Other regions), if you don’t have one

Yes, we work alongside your accountant and tax advisor to provide seamless financial management.

If your company’s annual revenues are between £2M and £50M, you are a strong fit for eSeller ACcountant.

Get Started with Taxomate Today!

If you’re ready to automate your eCommerce accounting and simplify VAT and sales tax compliance, our Taxomate Integration Service is the solution you need. Contact eSeller Accountant today to schedule a consultation and take your eCommerce business to the next level with automated financial management.